Fundamentals of corporate finance 11th ed – Welcome to the world of corporate finance, where Fundamentals of Corporate Finance, 11th Edition, takes center stage. This comprehensive guide unlocks the intricacies of financial management, empowering you with the knowledge and skills to navigate the complex world of corporate decision-making.

Through its in-depth analysis, this text provides a roadmap for understanding financial statements, evaluating capital projects, determining the cost of capital, and exploring various financing options. Join us on this journey as we delve into the fundamental principles that drive corporate financial success.

Introduction to Corporate Finance

Corporate finance is the area of finance that deals with the sources of funding, and the capital structure of corporations, the actions that managers take to increase the value of the firm to the shareholders, and the tools and analysis used to allocate financial resources.Corporate

finance professionals carry out several essential functions within a company, including:* Financial planning and analysis

- Capital budgeting

- Investment decisions

- Dividend policy

- Mergers and acquisitions

- Risk management

Financial Statement Analysis

Financial statement analysis is the process of evaluating a company’s financial health by examining its financial statements. Financial statements are prepared in accordance with specific accounting standards and provide valuable insights into a company’s performance, financial position, and cash flows.Financial

ratios are an important tool used in financial statement analysis to compare different companies and to track a company’s performance over time. Some common financial ratios include:* Liquidity ratios

- Solvency ratios

- Profitability ratios

- Market value ratios

Capital Budgeting

Capital budgeting is the process of evaluating and selecting long-term investment projects. Capital budgeting decisions are critical for a company’s success, as they can have a significant impact on its future profitability and growth.There are a number of different capital budgeting techniques that can be used to evaluate investment projects, including:* Net present value (NPV)

- Internal rate of return (IRR)

- Payback period

- Profitability index

Cost of Capital

The cost of capital is the rate that a company must pay to raise capital. It is an important factor in investment decisions, as it affects the profitability of a project.There are a number of different methods that can be used to calculate the cost of capital, including:* Weighted average cost of capital (WACC)

- Cost of debt

- Cost of equity

Long-Term Financing: Fundamentals Of Corporate Finance 11th Ed

Long-term financing is the type of financing that a company uses to fund its long-term assets, such as property, plant, and equipment. There are a number of different sources of long-term financing available to corporations, including:* Debt financing

- Equity financing

- Hybrid financing

Short-Term Financing

Short-term financing is the type of financing that a company uses to fund its short-term assets, such as inventory and accounts receivable. There are a number of different sources of short-term financing available to corporations, including:* Bank loans

- Commercial paper

- Factoring

Working Capital Management

Working capital management is the process of managing a company’s short-term assets and liabilities. Effective working capital management can help a company to improve its profitability and cash flow.There are a number of different strategies that can be used to manage working capital, including:* Managing inventory levels

- Managing accounts receivable

- Managing accounts payable

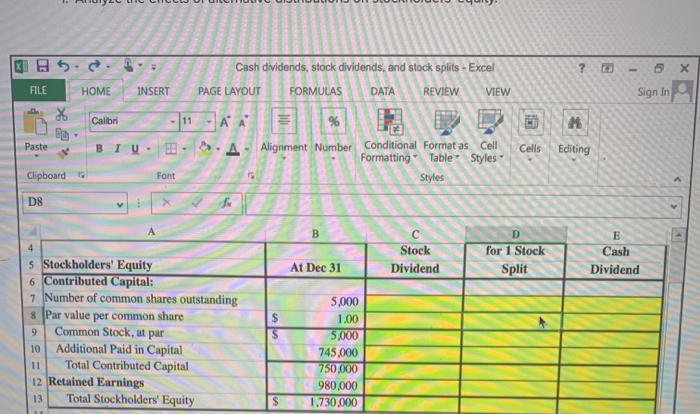

Dividend Policy

Dividend policy is the set of rules that a company uses to determine how much of its earnings to distribute to shareholders in the form of dividends. There are a number of different factors that a company must consider when setting its dividend policy, including:* The company’s earnings

- The company’s growth prospects

- The company’s capital needs

- The tax implications of dividends

Mergers and Acquisitions

Mergers and acquisitions are transactions in which one company acquires another company. Mergers and acquisitions can be used to achieve a number of different objectives, including:* Growth

- Diversification

- Cost reduction

- Market share

Corporate Governance

Corporate governance is the system of rules, practices, and processes by which a company is directed and controlled. Corporate governance is important because it helps to ensure that a company is run in the best interests of its shareholders.There are a number of different mechanisms that can be used to ensure corporate accountability, including:* The board of directors

- Independent auditors

- Regulatory agencies

General Inquiries

What is the scope of corporate finance?

Corporate finance encompasses all aspects of financial decision-making within a corporation, including capital budgeting, cost of capital, financing, and dividend policy.

How is financial statement analysis used in corporate finance?

Financial statement analysis provides insights into a company’s financial health, profitability, and liquidity, aiding in decision-making and investment evaluation.

What are the key factors that influence dividend policy?

Dividend policy is influenced by factors such as the company’s earnings, cash flow, growth prospects, and shareholder preferences.